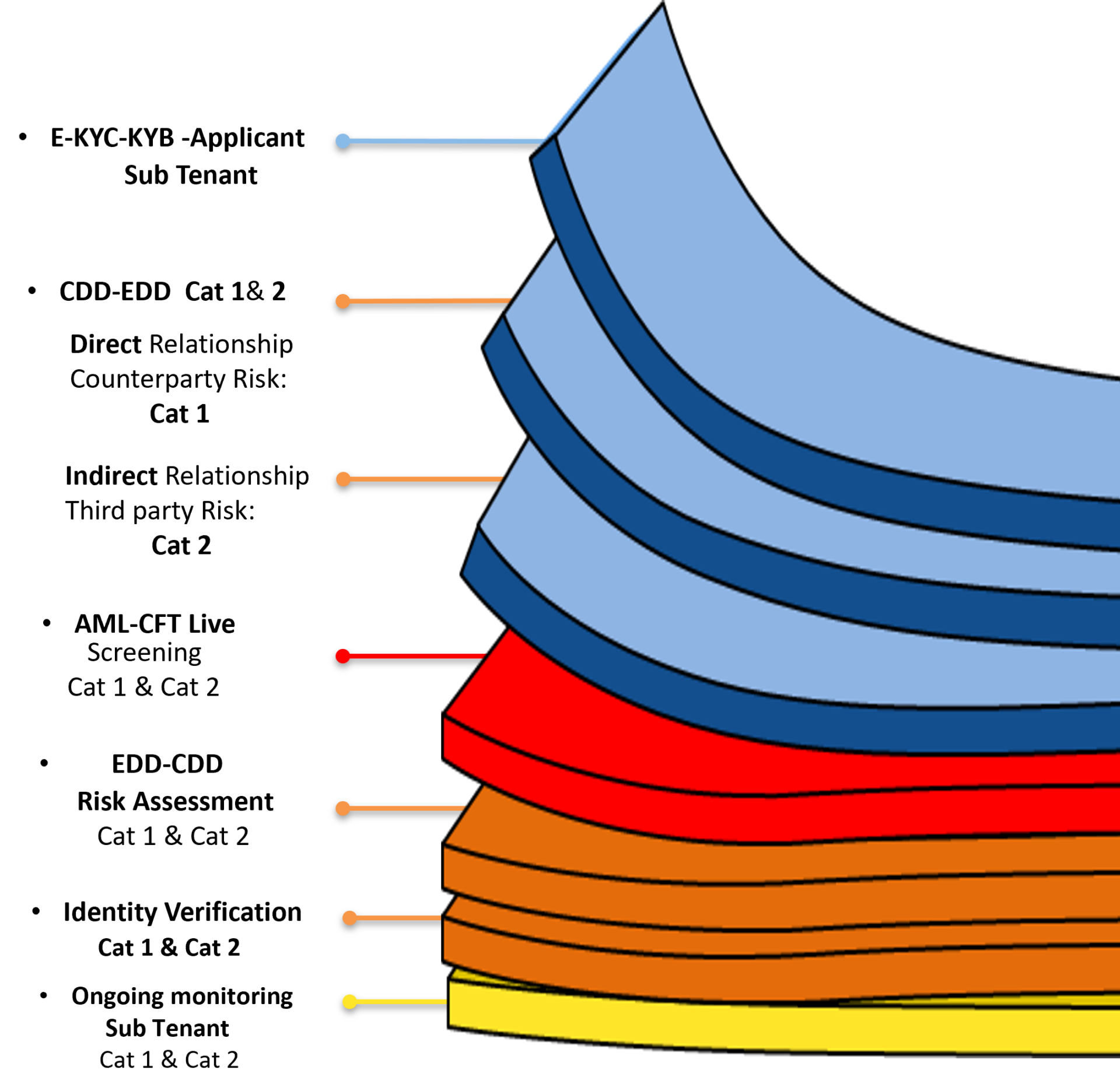

Keeps operations within the CRMS compliance framework.

Evaluates risks at all levels:

Tenant → Counterparty → Third Party → Sub-Tenant.

Tracks relationships and dependencies to prevent systemic risks.

Generates audit-ready documentation for AML/CFT compliance.

Supports external auditing processes to validate the integrity of compliance.

Level 1 provides a scalable, AI-driven compliance infrastructure that enhances efficiency, mitigates risk, and ensures regulatory alignment for tenants and their counterparts. By utilising automation and real-time screening, the platform provides seamless riskSupport for onboarding and ongoing monitoring, enabling businesses to operate in medium to high-risk environments.